Your browser doesn’t support HTML5 audio

Farmers across the U.S. could see a drop of nearly 25-percent in their farm income compared to last year. That’s what USDA is predicting—and that’s why your lawmakers in Washington, D.C. are looking for answers.

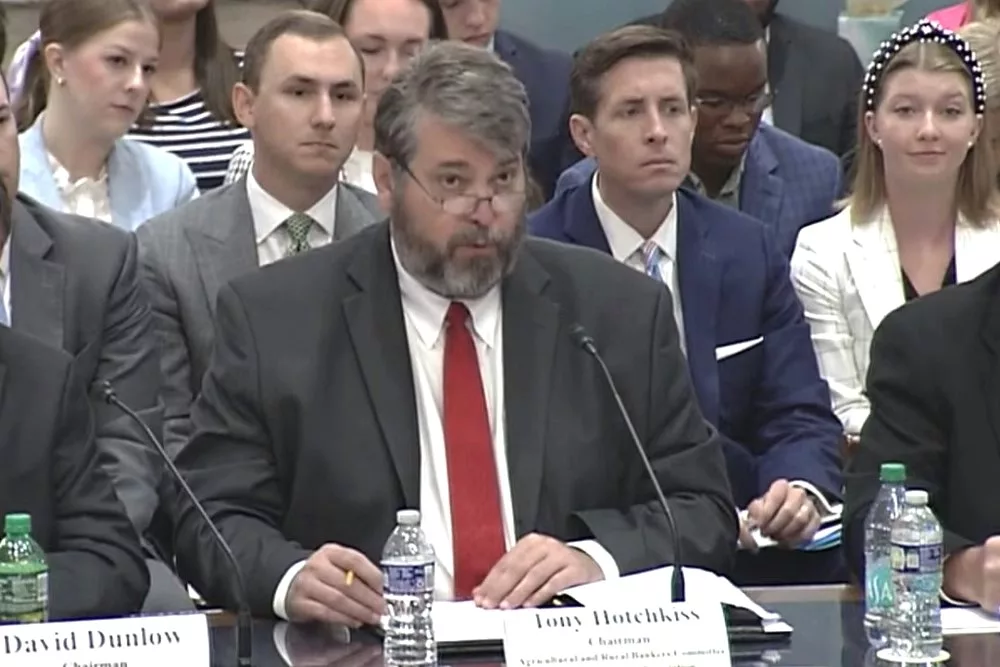

Evansville ag banker Tony Hotchkiss, who serves as Chairman of the Agriculture and Rural Bankers Committee of the American Bankers Association, testified before the House Ag Committee on Tuesday about the recent impact on the ag banking industry.

“Banks continue to be one of the first places that farmers and ranchers turn when looking for agricultural loans for their deep connection to farmers and ranchers,” said Hotchkiss. “Banks are often the first to see changes within balance sheets and cash flows on the farm operation often due to changing economic conditions.”

Hotchkiss told lawmakers that he and other ag bankers are already seeing the negative impacts of falling farm incomes.

“With rising input costs and lower commodity prices, farmers and ranchers have worked through the liquidity and working capital they build up over the past few years at a more rapid pace than anticipated and are now beginning to leverage equity through refinancing debt,” he says. “This has made agricultural bankers feel like they are looking over the cliff in regards to the agricultural economy.”

Hotchkiss encouraged lawmakers to pass a new Farm Bill and to keep current tax exemptions for farmers, such as the state tax and capital gains exemptions. He also said he supports the Access to Credit for Rural Economy Act (ACRE), which he said would create a level playing field for all lenders to agriculture.

Click BELOW to watch the full testimony from Evansville ag banker Tony Hotchkiss and others during the House Ag Committee hearing Tuesday on “Financial Conditions in Farm Country.” The hearing begins at the 2:00 mark: