Back in mid-May, agricultural producers weren’t in the best frame of mind. From the 10th to the 14th 400 U.S. producers were surveyed for the Ag Economy Barometer and their responses led to a 20-point decline in the May barometer to an 8-month low of 158.

Back in mid-May, agricultural producers weren’t in the best frame of mind. From the 10th to the 14th 400 U.S. producers were surveyed for the Ag Economy Barometer and their responses led to a 20-point decline in the May barometer to an 8-month low of 158.

Purdue University and CME Group create the regular update, and Purdue’s Jim Mintert says that taxes are a driver of this decline.

“There are a number of tax policy changes under consideration in Washington, and so we continue to ask farmers their perspective on tax policy, especially with respect to the impact it might have on estate taxes and their ability to pass farms onto the next generation of farmers in their family,” he explained. “Overwhelmingly farmers are telling us that they are very concerned about changes in tax policy, making it more difficult to pass their farm onto the next generation.”

Seventy-eight percent of survey respondents said they are very concerned and 83% of producers expect capital gains tax rates to rise over the next five years; 71% are very concerned about a possible loss of the step-up in cost basis for inherited estates; and 66% say they are very concerned about a possible reduction in the estate tax exemption for inherited estates.

The report says producers were less optimistic about both current conditions and the future of the agricultural economy, as both the index of Current Conditions and index of Future Expectations fell.

There was also a 10-point drop in the Farm Capital Investment Index for a couple of reasons, Mintert says.

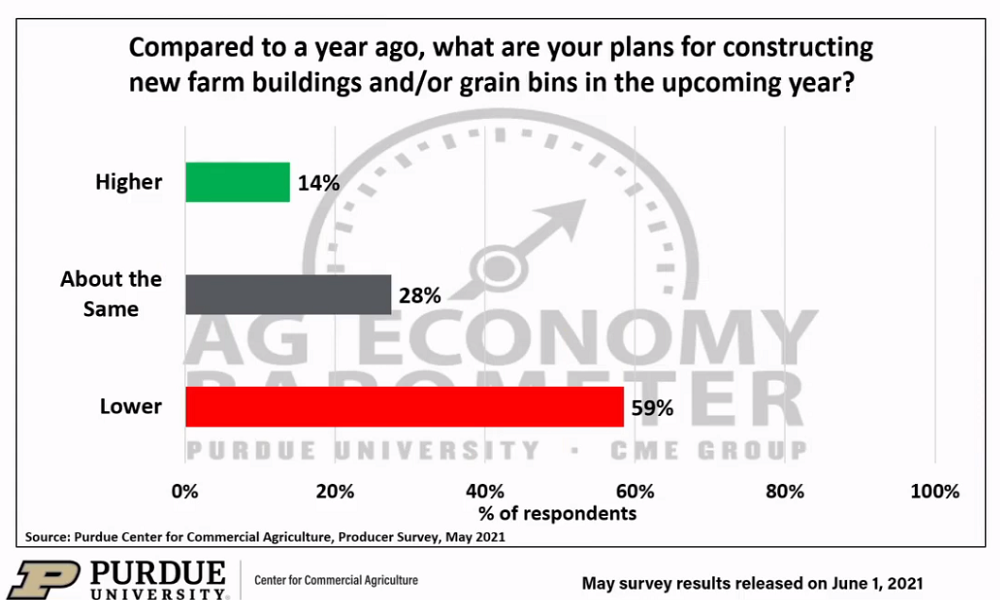

“There was an increase in the number of farmers who said they planned to reduce their farm machinery purchases in May vs. April, and as you look at a new question this month, we asked people what their plans are for constructing new farm buildings and/or grain bins in the upcoming year. Fifty-nine percent of the producers said they plan to reduce their purchases and construction of new farm buildings and grain bins.”

Mintert, the barometer’s principal investigator and director of the Purdue Center for Commercial Agriculture added, “rising construction costs are likely a contributing factor to weaker construction plans.”

Rising input costs, and some are rising significantly, are also driving the overall barometer lower.

There are still some positive takeaways from the May Barometer, even though producers expressed less optimism about their farm’s financial performance this month. The Farm Financial Performance Index declined to 126 from a record high 138 in April. Although May’s index was 12 points lower than a month earlier, it was still the second highest reading since the financial performance question was first posed in spring 2018, suggesting strong crop prices continue to support farm incomes.

After declining last month, the Long-Run Farmland Value Expectations Index rose 10 points to a record high reading of 158, with two-thirds of producers in the survey saying they expect farmland values to rise over the next five years. The Short-Run Farmland Value Expectation Index remained near its all-time high, falling just 2 points below the record high set in April of this year.

Producers also remain bullish on cash rental rates. On the May survey, producers who grow corn or soybeans were asked about their expectations for cash rental rates in 2022. Two-thirds (65%) of the corn/soybean growers in the survey expect next year’s cash rental rates in their home area to rise above 2021’s. In a follow-up question, producers who said they expect rental rates to rise were asked by how much they expect them to increase in the next year. Forty-three percent of respondents said they expect 2022 cash rental rates to rise by 10% or more, and 39% said they expect cash rental rates to rise from 5% to as much as 10%.

Producers’ expectations for good versus bad times in U.S. agriculture have undergone a marked shift. For example, in May just 27% of respondents said they expect good times in U.S. agriculture during the next five years, the lowest reading in the survey’s history and down 12 points from a month earlier. One driver of this shift appears to be the discrepancy between expectations for the crops versus livestock sectors in the upcoming five years. This month over half (54%) of respondents said they expect widespread good times for the crops sector in the next five years, whereas just one-fourth (26%) of producers said they expect widespread good times for the livestock sector.

“The difference in expectations for these two principal sectors of the agricultural economy could help explain why producers appear to be very bullish about farmland values and cash rental rates while at the same time expressing less optimism about both current conditions and future expectations for the agricultural economy overall,” Mintert said.

Source: Purdue News Service